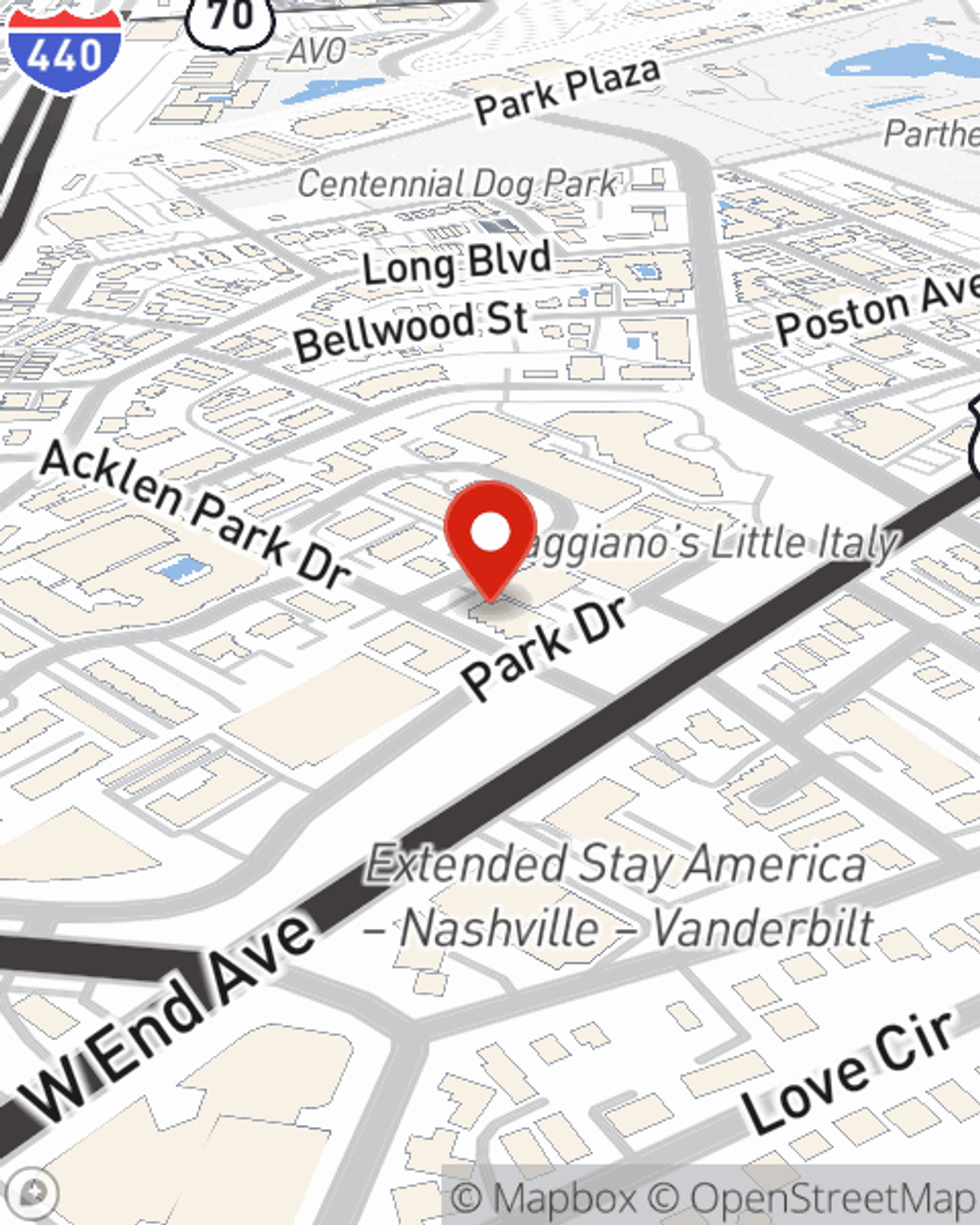

Business Insurance in and around Nashville

One of the top small business insurance companies in Nashville, and beyond.

This small business insurance is not risky

- Hendersonville

- Gallatin

- Antioch

- Brentwood

- Clarksville

- Franklin

- Hermitage

- Murfreesboro

- Belle Meade

- Bellevue

- Old Hickory

- Green Hills

- Goodlettsville

- Donelson

- Lebanon

- La Vergne

- Nolensville

- Dickson

- Smyrna

- Spring Hill

This Coverage Is Worth It.

Running a small business requires much from you. Insuring your venture should be the least of your worries. State Farm insures small businesses that fall under the umbrella of trades, contractors, specialized professions and more!

One of the top small business insurance companies in Nashville, and beyond.

This small business insurance is not risky

Customizable Coverage For Your Business

The passion you have to serve your customers is a great foundation. When you add business insurance from State Farm, you can be ready for the challenges ahead. That’s why entrepreneurs and business owners turn to State Farm Agent Andrew Judd. With an agent like Andrew Judd, your coverage can include great options, such as commercial auto, worker’s compensation and commercial liability umbrella policies.

The right coverages can help keep your business safe. Consider calling or emailing State Farm agent Andrew Judd's office today to review your options and get started!

Simple Insights®

Retirement plans for small business owners to consider

Retirement plans for small business owners to consider

Offering a retirement plan, including a SEP IRA, SIMPLE IRA or a 401k, is a great way for a small business to attract and retain employees.

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".

Andrew Judd

State Farm® Insurance AgentSimple Insights®

Retirement plans for small business owners to consider

Retirement plans for small business owners to consider

Offering a retirement plan, including a SEP IRA, SIMPLE IRA or a 401k, is a great way for a small business to attract and retain employees.

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".